“Hidden” costs can significantly increase the financial burden of homeownership in Los Angeles and Orange counties.

Zillow has brought to light what it calls “hidden” ownership expenses. To me, the figures highlight what’s better dubbed “sometimes ignored” costs when affordability hurdles for house hunters are pondered. We’re talking maintenance, property taxes, and insurance.

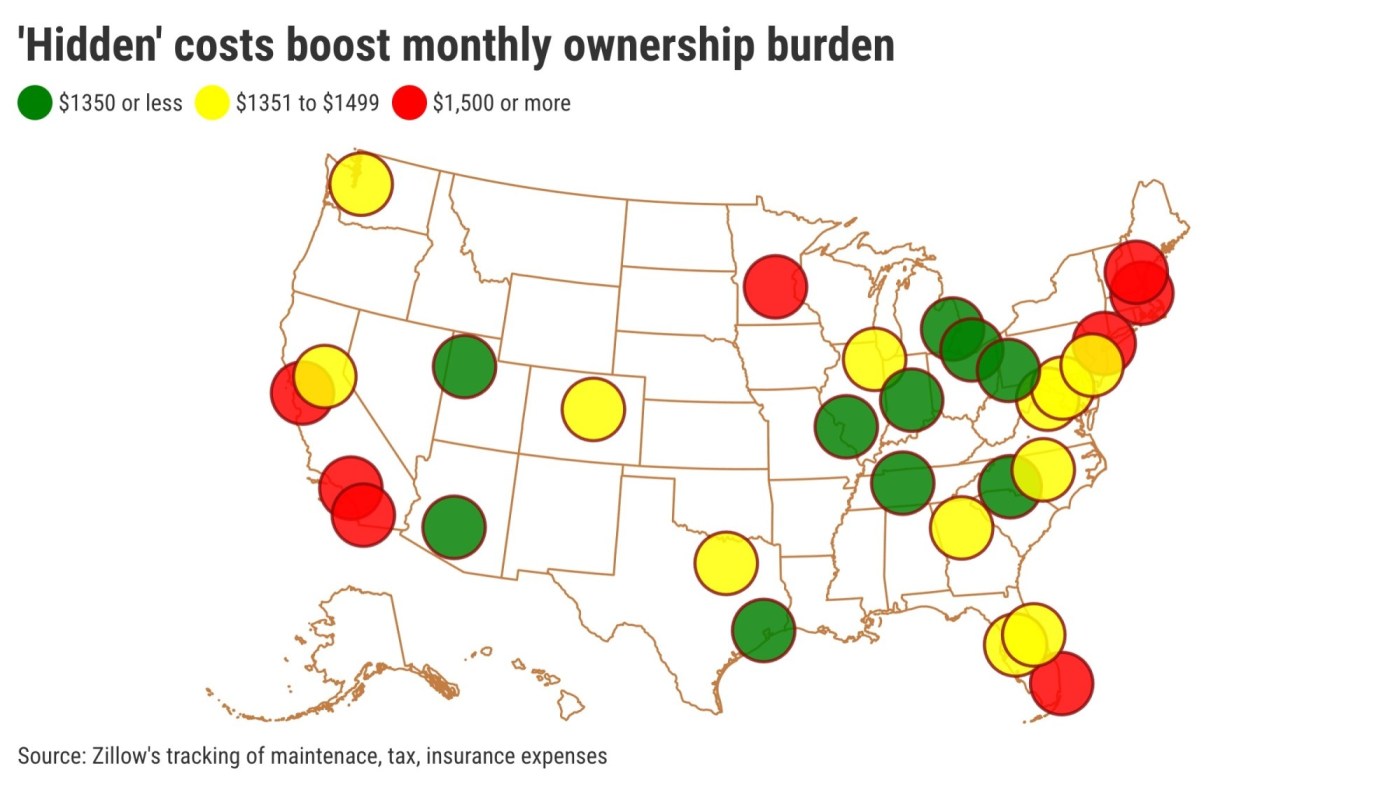

Zillow found that a typical household budget for an LA-Orange County owner should also include an additional $1,610 for “hidden” costs, ranking sixth-highest among 30 large metropolitan areas studied nationwide.

My trusty spreadsheet contrasted Zillow’s cost estimates with the big cost – the mortgage. Using a Zillow home value estimate for LA-Orange County – and a 6.4% 30-year loan, assuming a 20% down payment – a common buyer today would face an estimated monthly payment of $4,794 on a typical $949,000 residence. That’s the second-highest payment among the 30 markets tracked. No. 1 was San Francisco, by the way.

So, hidden costs boost budgeted costs by 34% to $6,404, also No. 2 nationally.

Financially speaking, ownership is more than just repaying the lender. Zillow highlights costs that persist even if you pay cash for a home or have paid off your home loan.

Break it down

How do these extra expenses break down locally?

First, a typical house hunter should budget $918 per month for maintenance, according to Zillow, which is the 13th highest among the 30. My four decades of ownership suggest that these expenses vary widely – for months or years, they are minor.

Well, until something expensive to fix breaks down or stops working altogether. Then you’ll be happy you have a “rainy day” fund for the not-really-surprising housing expenses.

Plus, there are the more predictable expenses, such as taxes and insurance. By the way, these costs are calculated into the mortgage qualification process. Zillow says that’s another $692 a month on the typical home, sixth-highest nationally.

So, a wannabe LA-Orange County owner may see a 34% hidden-cost increase.

Not just here

Ponder the three other California metro areas in the study.

San Francisco: $5,572 mortgage payment (No. 1) for a $1.1 million residence – plus $1,898 in “hidden” costs (No. 2) – for $7,470 monthly total (No. 1). That’s $974 for maintenance (No. 4) and $925 for taxes and insurance (No. 2). So, a 34% hidden-cost boost.

San Diego: $4,636 mortgage payment (No. 3) for a $917,600 residence – plus $1,591 in “hidden” costs (No. 7) – for $6,227 monthly total (No. 3). That’s $927 for maintenance (No. 9) and $663 for taxes and insurance (No. 7). Or a 34% budget boost.

Sacramento: $2,907 mortgage payment (No. 8) for a $575,300 residence – plus $1,471 in “hidden” costs (No. 12) – $4,378 monthly total (No. 8). That’s $918 for maintenance (No. 11) and $553 for taxes and insurance (No. 12). Or a 51% budget boost.

And while the costs may be lower in the 26 metro areas outside California, the “hidden” shock may seem more painful.

The median results for those 26 markets show a $1,951 mortgage payment for a $386,200 residence – plus $1,356 in “hidden” costs – for a total of $3,307 a month. Hidden costs –$889 for maintenance and $487 for taxes and insurance – boost a budget by 69%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com