Why are house hunters so reluctant to buy in Orange County?

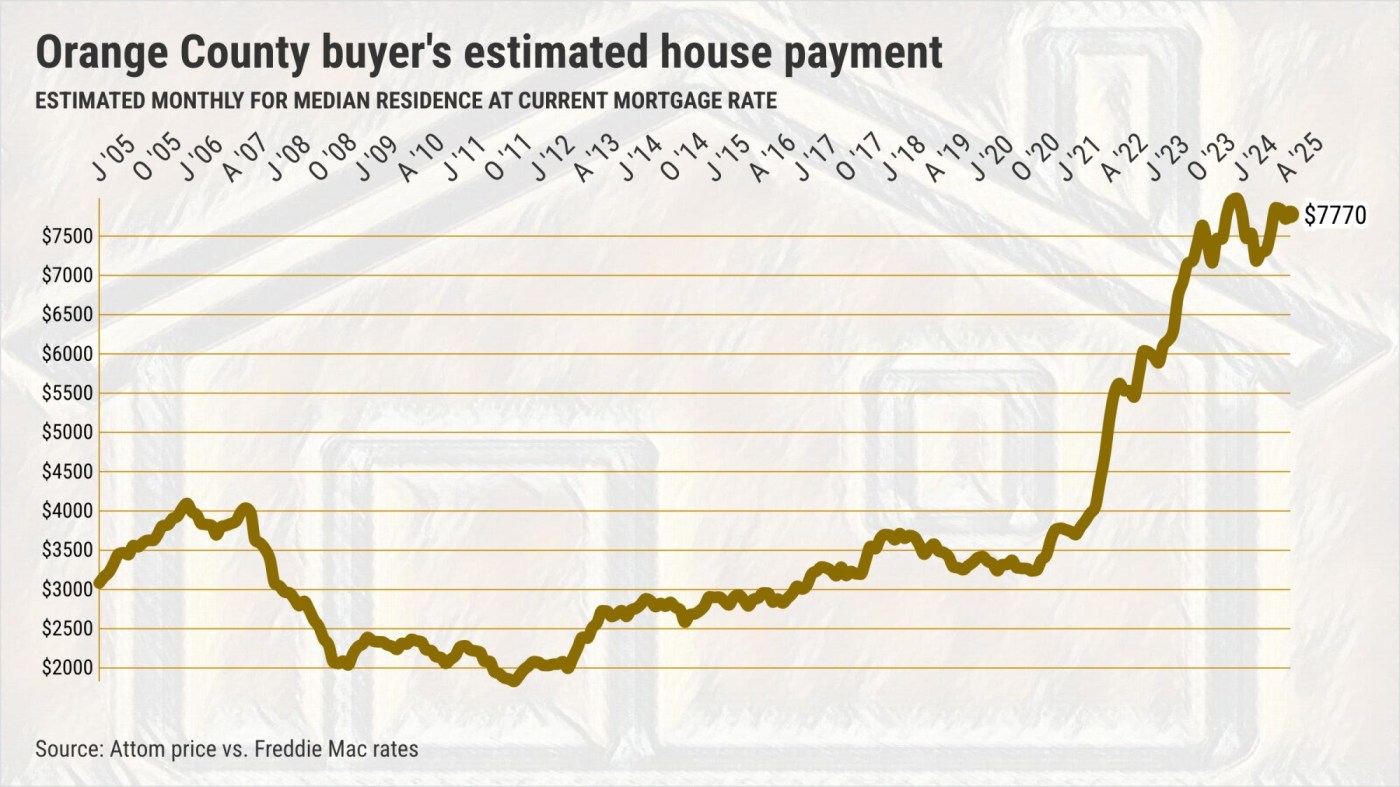

Well, the house payment they’d get has more than quadrupled since their post-Great Recession lows.

To track the affordability woes of housing, my trusty spreadsheet analyzed median sale prices from Attom and 30-year fixed mortgage rates from Freddie Mac. An estimated house payment was calculated for all residences – including houses and condos, both existing and newly built properties – assuming a 20% down payment.

In May, the $1.2 million median-priced residence – financed at the 6.8% average rate of the previous three months – cost an estimated $7,770 per month. That’s the seventh-highest buyer’s burden since 2005.

The last bargain?

Go back to this payment yardstick’s February 2012 post-crash low.

That’s when the housing market was digging itself out of the rubble of the bubble’s bursting.

This same homebuyer’s cost was only $1,821 that month. How? Mortgage rates were 3.9% and the median home price was $385,000.

Of course, you’d have to have the nerve to buy back then. Prices slid 38% in the previous five years.

Contrast that to May 2025, when a house hunter was faced with prices up 63% in five years.

It adds up to the Orange County house payment skyrocketing 327% since its post-crash, bargain-basement bottom.

And prices, up 212% in the period, are roughly two-thirds of the problem.

How reluctant?

Orange County home sales ran 29% below average in May.

The 2,154 closed transactions were off 8% in a year and far below the 3,029 average since 2005. It was also the second-slowest May over 21 years.

We’re witnessing long-running stagnation.

Consider that the 24,342 residences sold in the 12 months ended in May are 25% below the average yearly pace over the past two decades.

The price is wrong

Good news, Orange County! Price relief may be brewing.

Yes, the county’s median selling price for May equals the all-time high set in May 2024.

But look at appreciation. Gains averaged 10.3% annually over the last five years.

However, the median price has been flat in the past 12 months. It’s the worst performance in the previous two years.

Not just here

Payment pain is not suffered just by local house hunters.

6 Southern California counties: $825,500 median costs $5,345 a month in May vs. the January 2012 low when the $260,000 residence cost $1,235 monthly. That’s a 333% payment jump.

California: $750,000 median costs $4,856 in May vs. January 2012’s $232,000 residence that cost $1,102 monthly – a 341% jump.

Nationwide: $367,000 median costs $2,376 a month in May vs. February 2012’s $136,325 residence that cost $645 monthly – a 269% jump.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com