It’s hard to find a local boss in a hiring mood.

Of 15 major Southern California employment niches, nine cut jobs during the last 12 months, while just six grew payrolls at a pace topping their historical job creation patterns.

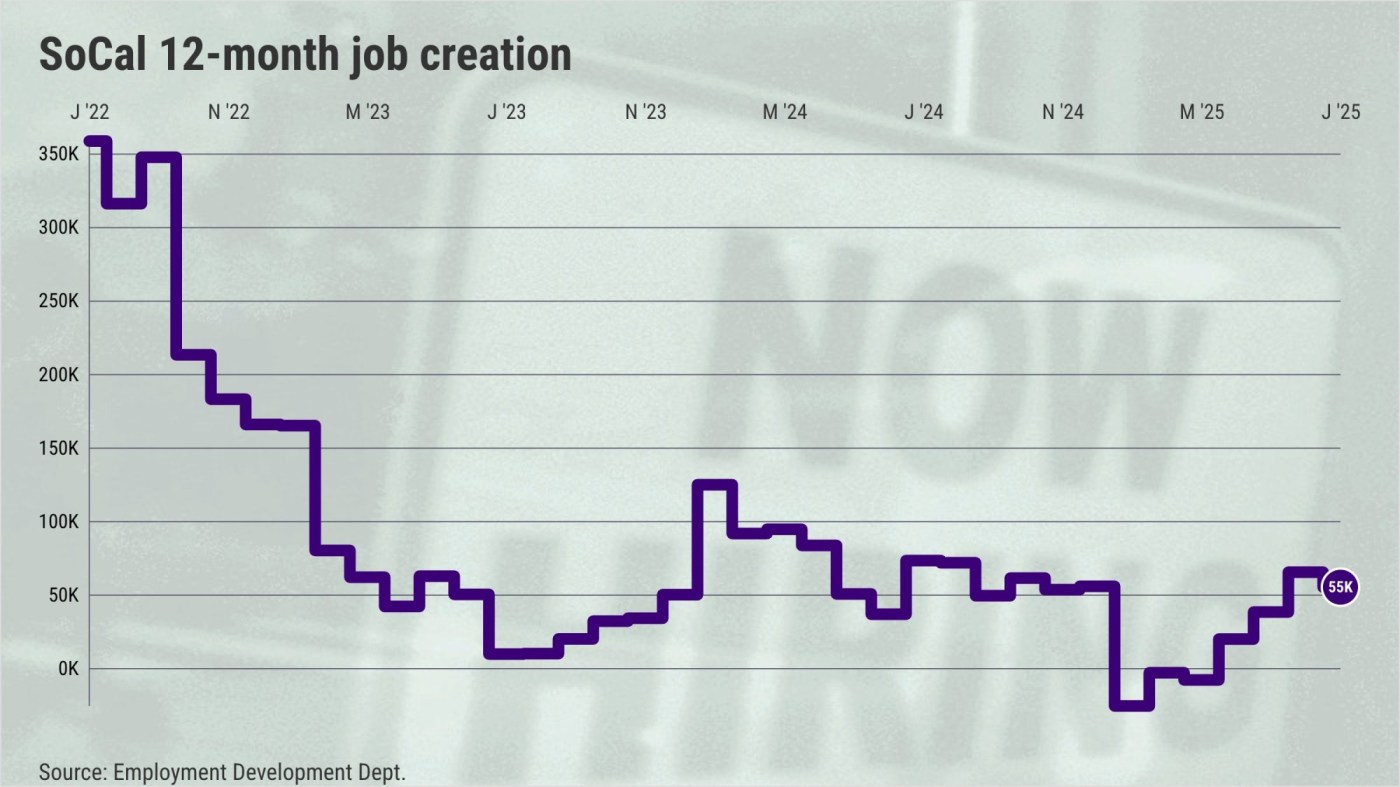

My trusty spreadsheet, filled with July’s state job figures, found that bosses across Los Angeles, Orange, Riverside and San Bernardino counties employed 7.95 million workers — up 55,000 in the past 12 months.

If you want to see Southern California’s economy cooling, note that current job creation trails the 104,300 average annual employment growth since 2010. That’s 47% below par.

There’s plenty of uncertainty about how the new administration’s economic policies will work, causing many consumers and corporate leaders to pull back.

Consider the split economy this way: Southern California’s expanding industries collectively added 120,700 workers, while contracting sectors had a total of 65,600 cuts.

So, contemplate the past year’s mixed employment within these major local business sectors, ranked by their 12-month change in job counts through July. Also, note how July’s staffing compares to each sector’s median job creation since 2010.

Let’s start with Southern California cuts.

Manufacturing: The long-suffering sector had 544,500 workers in July — down 18,100 during the past year. That loss is larger than the 5,100 historical annual decline.

Construction: Weighed down by high interest rates, this sector had 362,600 workers — down 16,400 from the previous year. That trails the 8,600 historical growth.

Professional-business services: Office work, usually high-paid positions, had 1.12 million job — down 9,500 in the pastyear. That trails the 15,300 historical growth.

Financial: High interest rates also hurt this sector with 48,100 workers — down 8,700 in the past year. That trails the 500 historical decline.

Fast-food restaurants: Labor costs boosted by a targeted minimum wage hike left 46,900 workers — down 6,800 in the past year. That trails the 8,300 historical growth.

Logistics-utilities: Trade battles and less consumer spending translates to 794,300 workers — down 2,400 in the past year. That trails the 14,700 historical growth.

Personal services: Expensive labor cut demand. Just 265,700 workers — down 1,700 in the past year. That trails the 3,100 historical growth.

Retailing: Shopping pullback meant 718,600 workers in stores — down 1,400 in the past year. That trails the 2,800 historical growth.

Full-service eateries/food service: Folks watching their budgets cool dining out. So there’s 33,100 workers — down 600 in the past year. That trails the 4,700 historical growth.

Now, ponder the six still growing:

Healthcare: The aging population requires more medical care. So, 871,100 workers — up 39,500 in the past year. That tops the 19,700 historical growth.

Social assistance: Same demographic boost to 542,900 workers — up 36,500 in the past year. Tops 17,800 historical growth.

Government: Budget challenges should cool this sector. Still, 996,300 workers — up 18,400 in the past year. Tops 4,900 historical growth.

Private education: Popular schooling option with 200,900 workers — up 15,400 in the past year. Tops 4,700 historical growth.

Hotels/entertainment/recreation: People still want fun. Thus, hospitality employs 284,500 — up 6,000 in the past year. Tops 5,700 historical growth.

Information: End of Hollywood labor disputes left 223,100 workers in creative and technology niches — up 4,900 in the past year. Tops 400 historical decline.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com