Southern Californians seeking an apartment deal are finding this chore is getting tougher.

My trusty spreadsheet reviewed April’s rent report from ApartmentList for the 250 largest U.S. cities, including 32 from Southern California. ApartmentList combines pricing patterns for all-sized rentals from its own listings with government rent-cost data to create its rent indexes.

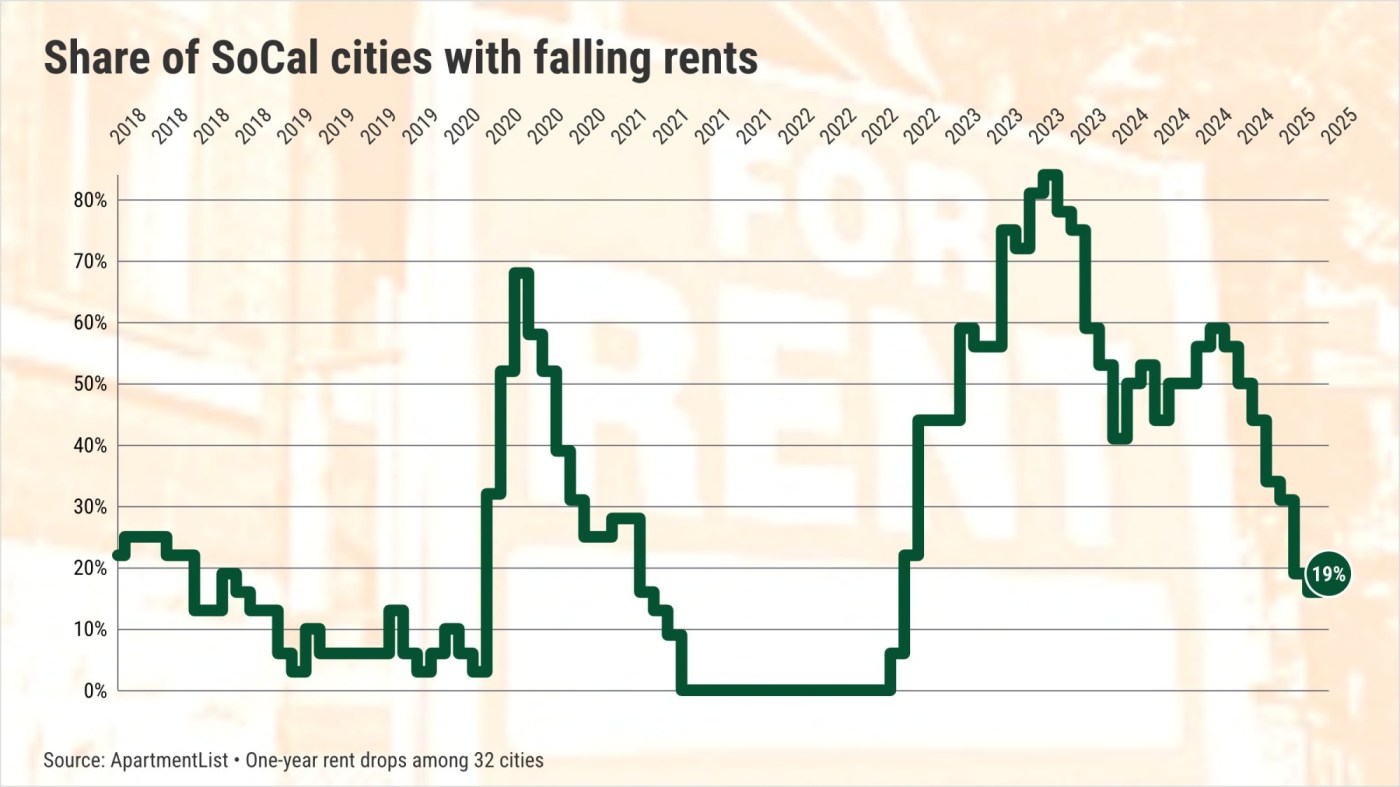

Locally, the statistics show rents declined from April 2024 in just six of the 32 markets tracked, or 19%. That compares with price drops in 14 markets, or 44%, in the previous 12 months.

Or consider how the region’s median rent has swung over two years. It was $2,245 a month in the 32 markets in April – up 1.5% from the previous year compared with a 0.2% decrease in the year ending in April 2024.

Let me remind you that price cuts were found in an average 49% of local cities for all of last year and in 66% of the big rental markets in 2023. Of course, there was the renter pain of 2022 when only 10% of cities had price dips.

So why did landlords regain pricing power? Well, a construction boom cooled, easing supply growth. Meanwhile, homebuying remained prohibitively unaffordable, upping demand.

Plus, January’s horrific wildfires in Los Angeles County, which destroyed 11,000 homes, increased the need for rentals.

Renting elsewhere

Tenants in the rest of the state saw a similar pricing pattern, suggesting California’s tardy home construction pace may be a major culprit in rent’s rebound.

Apartment prices declined in the past year in only two of 16 California markets outside of the south, or 13%. Compare that with cuts in seven markets, or 44%, in the previous 12 months.

April’s median rent was $2,474 in non-Southern California markets – up 0.4% in the past year vs. a 1.7% gain previously.

Nationally, discounting remains common as apartment developers were far more active outside of California in recent years.

Rents declined in 102 of the 250 U.S. markets tracked, or 41%, through April. That’s a slight decline in cuts from 126, or 51% of the 250 in the previous 12 months.

April’s median U.S. rent was $1,525 – off 0.6% in the past year vs. a 0.5% hike the previous 12 months.

Who’s cutting locally?

Here are the six Southern California markets with rent declines in the year ended in April …

Temecula: Off 4.3% past year vs. 0.8% gain in the previous 12 months, to $2,202 monthly.

Murrieta: Off 1.7% past year vs. 0.5% gain previously to $2,096.

West Covina: Off 1.2% past year vs. 0.3% dip previously to $2,158.

Long Beach: Off 1.2% past year vs. 0.6% gain previously to $1,759.

Escondido: Off 1.1% past year vs. 1.8% gain previously to $2,141.

Santa Clarita: Off 0.1% past year vs. 1.8% gain previously to $2,482.

And some of the region’s biggest gains are close to January’s wildfire damage …

Pomona: Up 6.1% in the past year vs. 1.6% gain in the previous 12 months to $1,973 monthly.

Pasadena: Up 5.2% past year vs. 1% previous gain to $2,574.

Oxnard: Up 4.7% past year vs. 1.8% previous gain to $2,255.

Victorville: Up 4.7% past year vs. 5.8% previous drop to $1,661.

Huntington Beach: Up 4.5% past year vs. 0.8% previous dip to $2,565.

True bargains

The region’s lowest rents among the 32 markets can be found in these five spots, as of April …

Victorville: $1,661 monthly – up 4.7% in the past year vs. off 5.8% previously.

Long Beach: $1,759 – off 1.2% past year vs. up 0.6% previously.

Riverside: $1,819 – up 1.5% past year vs. off 1.8% previously.

Moreno Valley: $1,905 – up 0.4% past year vs. off 0.8% previously.

Pomona: $1,973 – up 6.1% past year vs. up 1.6% previously.

And Southern California’s costliest places to rent, as of April …

Irvine: $3,028 monthly – up 2.2% in the past year vs. a gain of 1.1% in the previous 12 months.

Thousand Oaks: $2,883 – up 2.1% past year vs. up 1.4% previously.

Simi Valley: $2,823 – up 1.1% past year vs. up 2.8% previously.

Costa Mesa: $2,599 – up 3.8% past year vs. up 2.5% previously.

Pasadena: $2,574 – up 5.2% past year vs. up 1% previously.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com