Why so few home sales in Los Angeles and Orange counties?

Well, local renters enjoy the nation’s fourth-largest savings between what landlords charge and the cost of financing a house purchase.

My trusty spreadsheet reviewed a study by Zillow that estimated everyday rent prices for single-family homes compared to monthly mortgage payments, assuming 10% down. The study looked at April conditions for 50 large U.S. metropolitan areas, including six California markets.

Of course, renting in the metro comprising Los Angeles and Orange counties remains a financial challenge. Leasing of a single-family house ran $4,462 a month, according to Zillow’s math. That’s the second-highest cost among the 50 markets.

But buying is far more painful to the wallet. Zillow estimates buying the $966,700 typical home requires a $6,315 house payment. That’s the third-highest nationally.

Still, the rent vs.-buy math translates to a $1,853 monthly savings to the tenant, No. 4 of the 50. Yes, nearly two grand.

My spreadsheet looked at this theoretical renting advantage with a longer-term lens: Over five years, assuming that renting’s savings are cut 3% a year as the landlord raises prices. It adds up to roughly $105,000 cheaper to rent.

Now, mortgage payments and property taxes could lower a buyer’s income taxes. Of course, then there’s potential increases in property taxes, insurance and homeowner association fees a buyer must account for, too.

And please do not forget the 10% down used to get a reduced mortgage payment in this calculation. That’s a severe house hunter burden that is often overlooked in rent vs. buy math. For Los Angeles-Orange County, it’s $96,700 down.

Also, homeownership fans would say a buyer could see $154,000 of appreciation if home prices increased at a 3% a year pace in the next five years.

Yet no matter how the rent vs. buy calculations are done, the cash-flow gap between rents and house payments helps explain the locally slow homebuying pace.

Elsewhere

In the five other California markets, the five-year savings for renters were …

San Jose: $350,000 savings (No. 1 among the 50 markets) from $4,508 rent (No. 1) vs. $10,706 on house payment (No. 1).

San Francisco: $198,000 savings (No. 2) from $4,065 rent (No. 5) vs. $7,564 payments (No. 2).

San Diego: $111,000 savings (No. 3) from $4,177 rent (No. 3) vs. $6,133 payments (No. 4).

Sacramento: $58,000 savings (No. 7) from $2,800 rent (No. 12) vs. $3,833 payments (No. 9).

Inland Empire: $43,000 savings (No. 11) from $3,085 rent (No. 9) vs. $3,838 payments (No. 7).

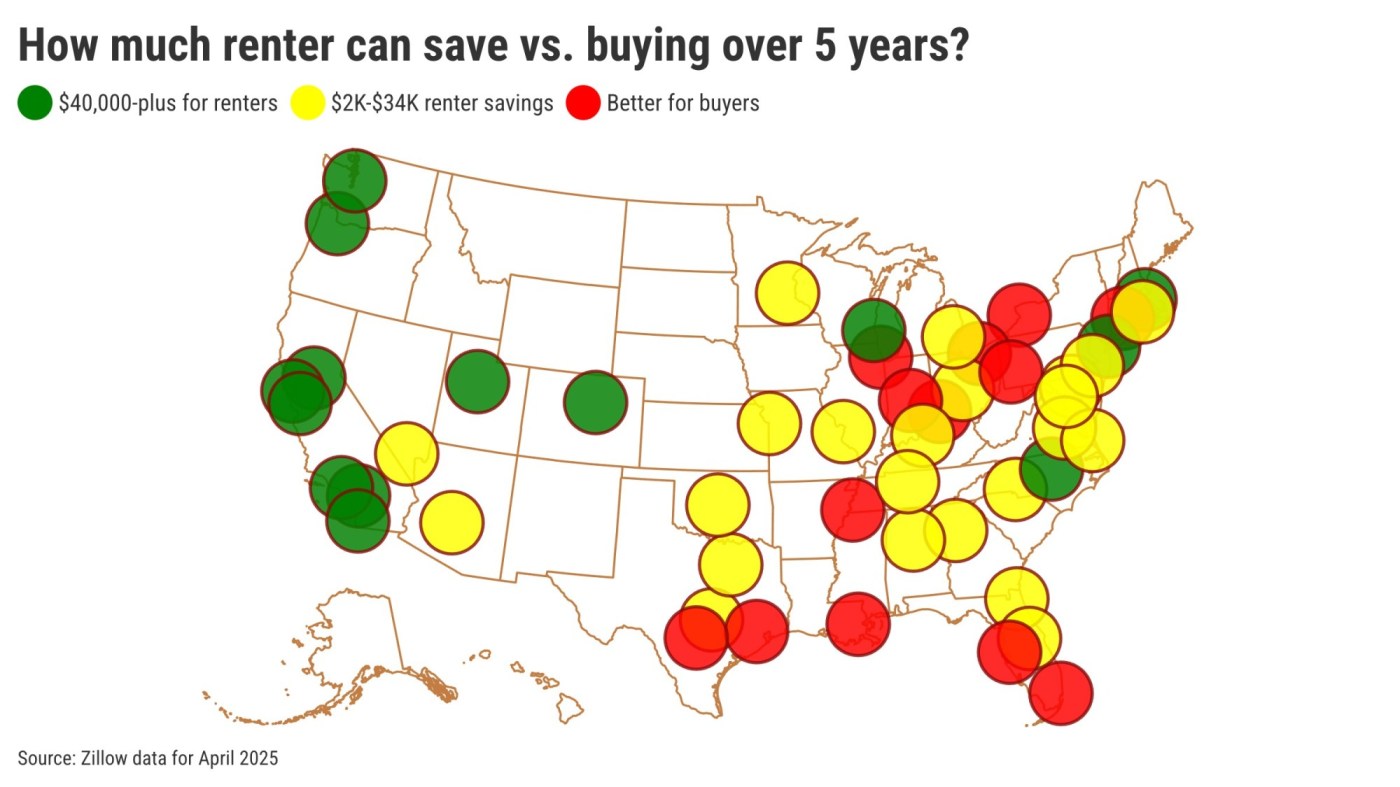

It’s a far different picture nationally.

A U.S. renter can expect just $5,000 savings over five years from $2,296 rent compared to $2,388 house payments.

And it was cheaper to buy than rent in 13 of the 50 U.S. big metro areas: Indianapolis, Hartford, San Antonio, Buffalo, Cincinnati, Cleveland, Memphis, Tampa, Houston, Pittsburgh, New Orleans, Chicago, and Miami.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com